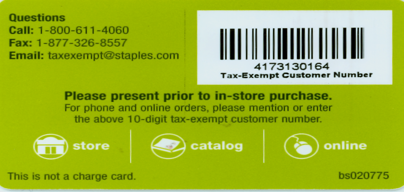

staples tax exempt certificate

Faxing it to us at 1-800-567-2260. How do i get tax exempt at staples.

Staples Com Customer Service Order Support

When setting up tax exemption you will need to provide.

. To Be Completed By Purchaser. And certificate of winding up if necessary certificate of withdrawal or certificate of surrender is filed with the California SOS. Applying for Tax Exempt Status.

Upload your signed certificate using the upload link on the Tax Information page. Vendors name and certifi or both as shown hereon. Looking for an answer to the question.

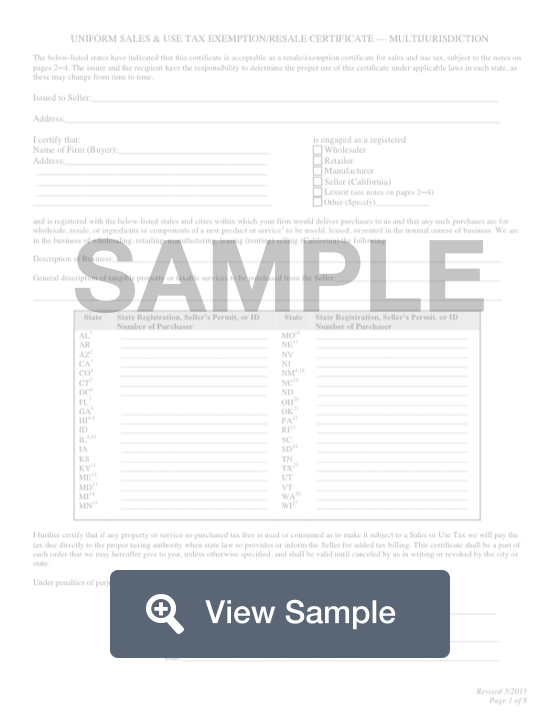

Sales Tax Exempt Certificate. Up to 5 cash back If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. Sales Tax Exempt Certificate - Staples.

Fax your signed certificates to 262-612-4276. Send us your tax exemption certificate using either of the 3 following methods. Your company contact information.

You can call the hotline number for the customer and see if they have something but if it isnt there then there is a 2 week process they have to go through to get it set up. Full List of Resources. Sales and Use Tax Exemption Numbers or Tax Exempt Numbers do not exist.

In addition the payment is subject to federal and state income taxes. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity. Ad Achieve Your Goals Stay Supplied With a Wide Variety of Office Supplies at Staples.

Please forward your tax exempt certificate to. Tax reporting requirements and Account Codes for Gift Cards and Gift Certificates by recipient type. Tax Department Processing.

On a cover sheet please include your telephone number and order number if. THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID. Staples Tax Exempt Certificate.

Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Enter your Staples Tax Exempt Customer Number in the field provided and click Continue. A sales tax certificate may also be called a resale certificate resellers permit resellers license or a tax-exempt certificate depending on your state.

Timeshare associations may qualify for tax-exempt status like other homeowners associations. If you are Tax Exempt. Staples Tax Exempt Certificate.

Up to 5 cash back If you are a tax-exempt organization and do not have a Staples Tax-Exempt Customer Number please follow these steps. Exemption Certificates for Sales Tax Tax Bulletin ST-240 TB-ST-240 Printer-Friendly Version PDF Issue Date. Sales Tax Exempt Certificate - Staples.

The current total local sales tax rate in Staples MN is 7375The December 2017. To Sunday August 8 2021 at 1159 pm. Tax Exempt Certificate for New York State AC946 Use when services or materials purchased will be paid for by the state and are tax-exempt.

Government-issued Tax Exemption Certificate. Download Sales Tax Exempt Certificate NetID login required Business Services has generated a UW-Madison Tax Exempt Status Letterdesigned to answer inquiries concerning our tax exempt status. See back of this form for instructions State of Wyoming.

New York State Tax Exempt Certificate AC946 pdf Mobile Users. If you have already registered with Staples Advantage and have received your logon information you do not need to fill out the registration form below. On this page we have gathered for you the most accurate and comprehensive information that will fully answer the question.

Street Address City State Zip Code. Please do not write on your tax certificate. As of January 31 2020 Form 1023 applications for recognition of exemption must be submitted electronically online at wwwpaygov.

I the undersigned hereby certify that I am making an exempt purchase as follows. A sales tax certificate is for exemption from sales tax you. When setting up tax exemption you will need to provide.

Sales Tax Exempt Certificate. Click Continue to create a new account. Who do I contact.

Issued to SellerDate Issued. Staples Provides Custom Solutions to Help Organizations Achieve their Goals. As of January 5 2021 Form 1024-A applications for.

Send the completed certificate to the Comptroller of Public Accounts. Purchaser must state a valid reason for claiming exception or exemption. How do i get tax exempt at staples.

Obtain Staples Tax-exempt Customer number by following this procedure. Once we have received the completed exemption certificate we will update your account within one business day. I dont care if they have paperwork from the state or US government if Staples doesnt have them on record for tax exempt then they arent getting it.

Gift cards of any amount given to employees must be reported to the Tax Office for reporting on the employees Form W-2. It allows your business to buy or rent property or services tax-free when the property or service is resold or re-rented. Download the Form.

On a cover sheet please include your telephone number and order number if applicable. Your order will be taxed and a refund generated as soon as our Tax Department verifies your tax exempt information. Up to 5 cash back Tax Exemption - All retail store purchases made using a Registered P-Card will be charged sales tax unless the Company a provides a valid tax exemption certificate at time of purchase b previously provided a valid tax exemption certificate at Retail and is in the Host Based Tax Look-up Database or c the Company shows a valid Retail Tax.

If you have not registered with Staples. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic. The purchaser fills out the certificate and gives it to the seller.

Fax your tax certificate to Staples at 888-823-8503. This certificate should be furnished to the supplier. You can go directly to the login page and begin ordering.

Wyoming or Out of State Vendors salesuse tax licenseregistration number. Below is a link that you can follow to download the Universitys tax-exempt certificate. Fax your tax certificate to Staples at 18888238503.

For the best experience in completing this form use a non-mobile device. Manuals Guides and Procedures. Click Log In on the top right corner of the homepage.

Staples tax exempt certificate Wednesday February 23 2022 Edit. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from. Government-issued Tax Exemption Certificate.

March 26 2010 Introduction Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. How do i get tax exempt at staples. This letter is used to.

Opening a new request with us HERE.

Twinings Orange Lotus Flower Green Tea 40g Amazon Ca Grocery Gourmet Food

Staples Com Customer Service Order Support

Intuit Turbotax Premier For 2021 Tax Returns Costco

How To Make Tax Exempt Purchases In Retail And Online Stores How To Make Money On The Internet

Sales Tax On Grocery Items Taxjar

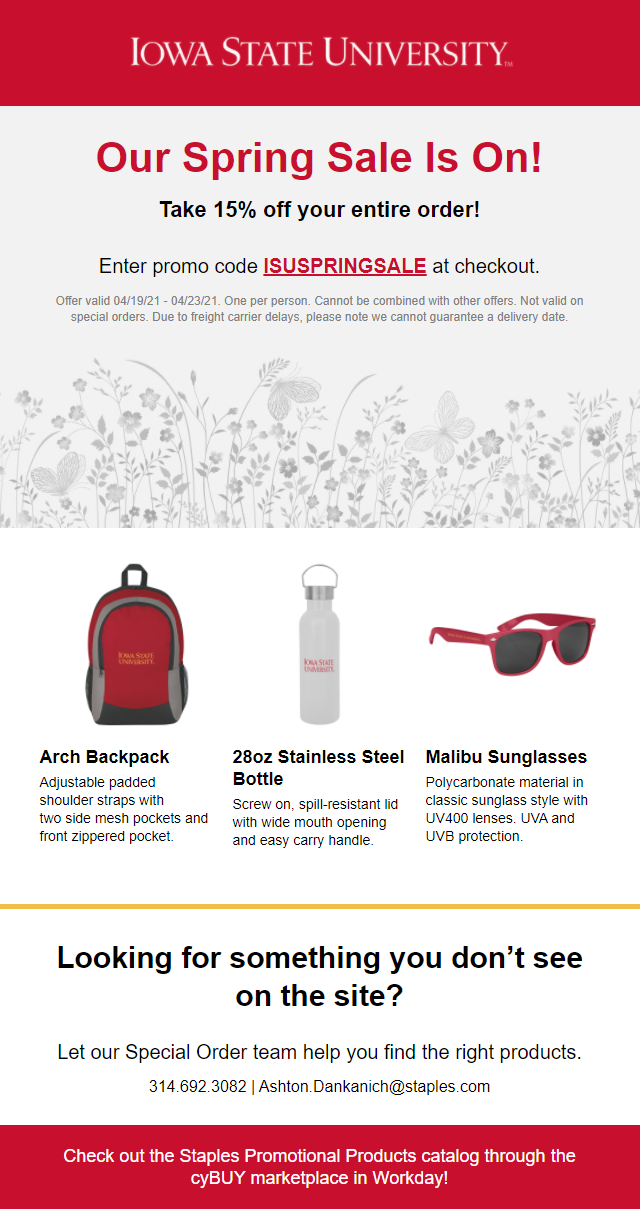

Staples Promotional Product Catalog Offer Procurement Services Iowa State University

Get And Sign Office Depot Tax Exempt Form

Tax Exemption Form Free Tax Exempt Certificate Template Formswift