tax abatement definition accounting

Factor in determining whether the transaction meets the definition of a tax abatement More simply put a tax abatement is when a local government or school district agrees to give up tax revenues it is entitled to in return for a promise by an individual or entity to. In broad terms an abatement is any reduction of an individual or corporations tax liability.

Sale Of Service With Tax Abatement Service Tax

Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which.

. A reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. TIF is not explicitly included or excluded as a tax abatement.

Whether revitalization efforts will ultimately prove successful is a big question mark. Taxpayers should understand the difference between tax abatement and tax penalty abatement to avoid confusion. Property Tax Abatements generally have a finite life offering the owner the benefit for only a specific period of time after which the owner is responsible to pay the full property tax amount.

To increase savings or spending rate invest in equipment or others. Your browser doesnt support HTML5 audio. Calling this tax abatement means that for example a.

The Governmental Accounting Standards Board GASB Statement No. The tax abatement is an incentive to encourage people to redevelop and move into these areas. For instance local governments may offer abatements to cover the cost of building new infrastructure to incentivize development or.

The filing period for the upcoming tax year ends on February 15. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction. The objective of this project is to determine what disclosure guidance for governments that have granted tax abatements if any is essential to financial statement usersFor purposes of this project tax abatements are a reduction of or exemption from taxes offered under an agreement between a government and a specific.

Recently the GASB published GASB Statement No. Tax abatement involves real estate properties while tax penalty abatement involves a taxpayer asking the IRS for a reduction or elimination of tax penalties for late tax payments or incorrect amount of taxes paid. A reconsideration is when a taxpayer submits information not previously considered after the issuance of a final determination.

Your browser doesnt support HTML5 audio. The amount of the abatement is based on the average assessed value of the residential units in the development. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control.

Penalty abatement removal is available for certain penalties under certain circumstances. A reduction of taxes for a certain period or in exchange for conducting a certain task. Tax abatements are the most frequent scenarios where the term is employed and they are a reduction or exemption.

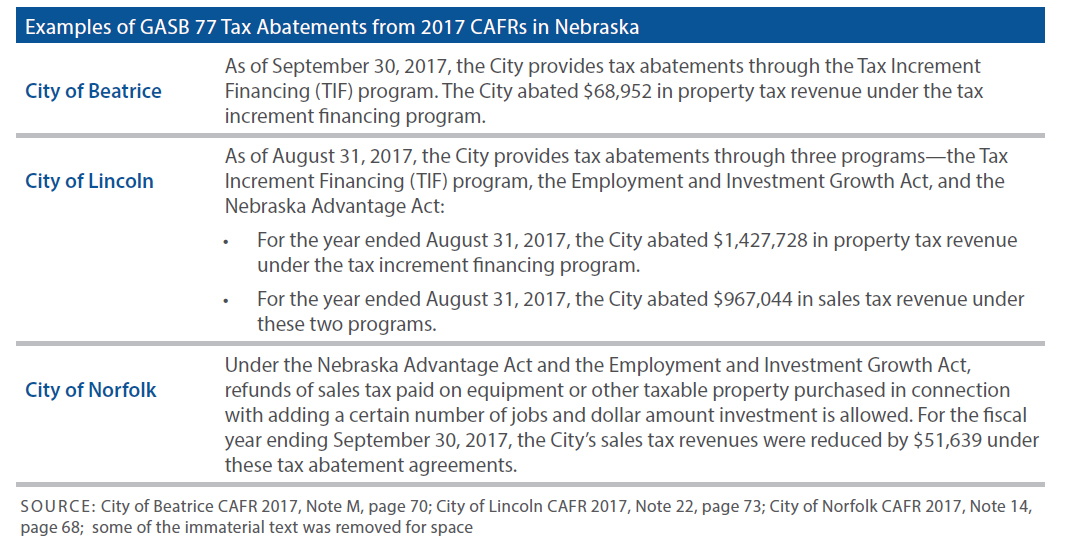

The dollar amount of tax revenues being reduced as a consequence of tax abatement agreements during the accounting period. The primary purpose for this new requirement is to provide. Tax Abatements Statement 77 applies only to transactions meeting this definition.

The term commonly refers to tax incentives that attempt to promote investments that boost economic growth or provide other social benefits. A one or more governments promise to forgo tax revenues to which they are otherwise entitled and. The definition of tax abatement in the GASB statement focuses on agreements between one or more governmental units and an individual or entity in which the governmental unit s will forgo tax revenue in exchange for economic development or other actions by the individual or entity.

A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. A taxpayer may request abatement of tax penalty and interest providing certain criteria for each are met.

The savings in that case results from the difference in the taxability or valuation of the lease. The term abatement refers to a situation where an economic burden is reduced. The development is eligible for a 10-year property tax abatement.

77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. A reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Owners of cooperative units and condominiums who meet the requirements for the Cooperative and Condominium Property Tax Abatement can have their property taxes reduced.

A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way. More from HR Block. Such arrangements are known as tax abatements.

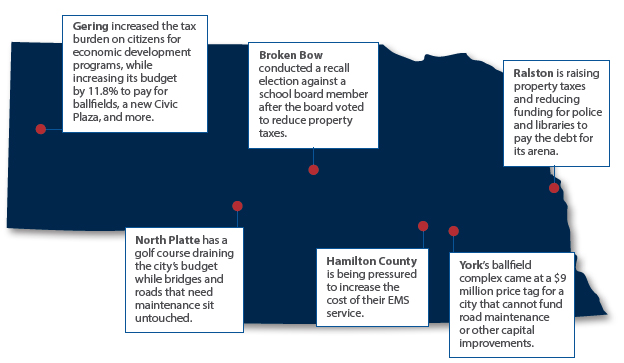

77 Tax Abatement Disclosures provides a definition of tax abatements which is for financial reporting purposes only and identifies required note disclosure related to tax abatements. Many tax abatements are not recorded at all in a governments accounting system because the taxes are never billed or collected that means the numbers in the financial statements do not reflect those tax abatements The Need for Information about Tax Abatements 15. Brief descriptive information that includes the names of the governments and dollar amount received or receivable from other governments if a governmental unit has amounts received or receivable from other governmental units in.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. Tax abatement represents a reduction of government revenue and therefore may. One or more governments promise to forgo tax revenues to which they are otherwise entitled and.

Noun C or U TAX FINANCE PROPERTY uk. IRS Definition of IRS Penalty Abatement. The information must be different than what was previously considered.

A sales tax holiday is another instance of tax abatement.

Due Dates Advance Tax Payments Due Date Tax Payment Tax Deducted At Source

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download